What is GAP Insurance?

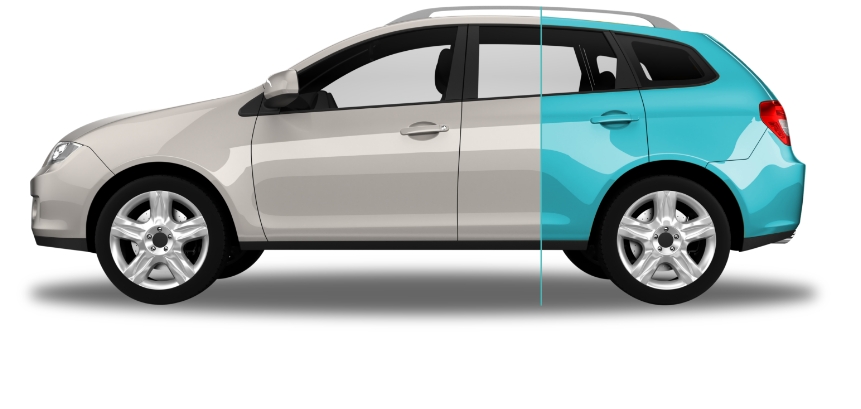

Combined Return to Invoice (RTI) and Finance GAP - in the event your car is either written off due to an accident or stolen and not recovered, causing your motor insurer to declare your vehicle a “total loss”, this policy will pay the difference between your motor insurers settlement and the greater of either the outstanding finance or the Invoice price of the vehicle.

Insurance Payout

GAP Payout

Purchase price of your vehicle £35,000

Motor Insurers Settlement £25,000

GAP Policy Payout £10,000

Key eligibility

-

Vehicle is under 10 years old at the time of sale with a purchase price of £5,000 or more

-

The GAP policy must be purchased no more than 90 days after purchasing the insured vehicle

-

You must have a fully comprehensive insurance policy throughout the duration of the GAP policy

Why choose MyCoverPlan Gap Insurance?

With our cost-effective insurance, and streamline claims process, MyCoverPlan make things simple. Whether your vehicle is involved in a total loss accident, fire or theft, our GAP insurance will pay the difference between your motor insures settlement and the greater of either the outstanding finance, or the invoice price of the vehicle.

-

£500 towards your motor excess, even on none GAP claims!

-

Rated excellent on Trustpilot

-

30 Day contribution towards a temporary replacement vehicle.

-

Covers up to £1,500 of dealer or factory fitted accessories.

-

You can transfer your policy to a family member for free

What GAP polices do we offer and what do they do?

-

MyCoverPlan Combined RTI and Finance GAP

In the event your car is either written off due to an accident or stolen and not recovered, causing your motor insurer to declare your vehicle a “total loss”, this policy will pay the difference between your motor insurers settlement and the outstanding finance/contract hire agreement of the vehicle.

We also offer the following products

-

Scratch & Dent Insurance

Coming soon!

-

Combined Tyre & Alloy Insurance

Coming soon!